2. A check or money order should be stamped

on the back with the words FOR DEPOSIT

ONLY into the proper account, or the authorized

signature(s) should be affixed for deposit.

3. If money is received on other than a regular

working day or when the bank is closed, it should

be counted and then locked in a safe until deposit

can be made.

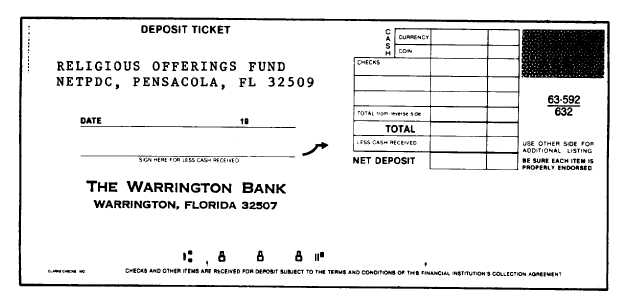

4. A bank deposit should be made on the first

working day after money is received. Figure 4-32

shows a typical bank deposit slip for the religious

offerings fund.

5. The amount of money received must be

posted to the proper subaccount on the Receipts

and Expenditures Records.

6. Deposits must also be entered on the stub

of the religious offerings fund checkbook, and the

new composite balance must be carried forward.

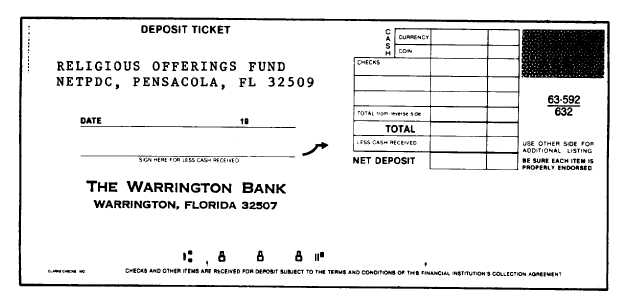

Checkbook

The religious offerings fund checkbook should

be of the type depicted in figure 4-33. The check

stub should be completed at the time each

transaction is made. When the canceled checks

are returned (usually monthly) by the bank, they

should be taped to the stubs. This package will

serve as a supporting voucher for all transactions

involving the religious offerings fund.

Bank Statements

Full-service banks usually service the religious

offerings fund account free of charge since the

fund is maintained by a nonprofit organization.

In this case there are no bank service charges

levied against, or any interest paid to, the religious

offerings fund. Some banks may pay interest on

checking or share draft accounts. As long as

no investment intent is implied, the religious

offerings fund can be administered at such a bank.

The command chaplain and the local comptroller

will give guidance in this area. The accounting

department of the bank usually issues a bank

statement to the fund accountant once a month.

This statement shows the balance at the beginning

of the statement period, plus all receipts and

minus all disbursements during the period, and

a composite balance at the end of the period.

Accompanying the statement are all certifications

of deposits that have been added to the fund and

all checks paid from the fund and canceled by the

bank. It should be noted that some checks written

against the account toward the end of the state-

ment period may not have been presented to the

bank for payment during the current statement

period. The religious offerings fund accountant

should account for these checks when reconciling

Figure 4-32.—Bank deposit slip.

4-32