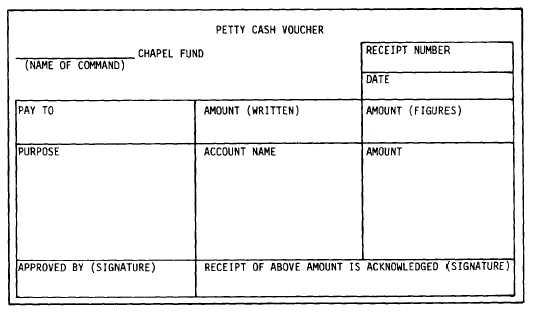

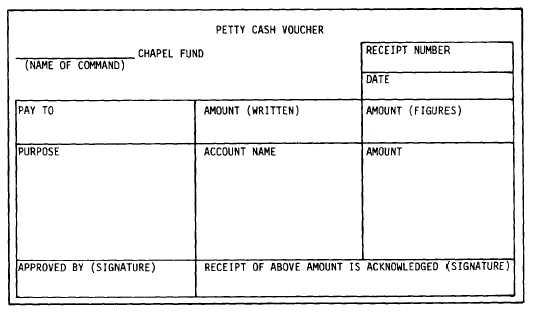

Figure II-4-11.—Petty Cash Voucher.

accounts of the fund. Each group would then

use the petty cash fund, including the replenish-

merit process, in the same manner as previously

explained. For explanation purposes, and to

emphasize that all of the religious groups or

categories that use the CRP chapel fund share

equally in the fund’s operation, the practice

accounting application in this manual will show

that has been drawn equally from the

Roman Catholic account () and the Protes-

tant account ().

PROPERTY AND EQUIPMENT

When accounting for property and equip-

ment, the cost of a particular item must first be

considered in order to determine what steps, if

any, need to be taken for accounting for that

item. Accounting for expendable and nonex-

pendable property/equipment will be explained

in the next two sections.

Expendable Property and Equipment

Expendable property and equipment is prop-

erty or equipment which has a unit value of less

than 0 and/or supplies and materials which

are immediately consumed in use or become

incorporated in other property, thus losing their

separate identities.

Nonexpendable Property

and Equipment

Nonexpendable property and equipment is

property or equipment which ordinarily retains

its original identity during use, has a unit acqui-

sition value of 0 or more, and a life expect-

ancy of more than 1 year.

The chapel fund administrator will account

for all nonexpendable property and equipment

acquired by the chapel fund on a Property and

Equipment Inventory Record (figure II-4-12).

This form must show a running dollar balance of

all nonexpendable property on hand. Separate

entries will be made for purchases and disposals.

Disposal of nonexpendable property requires

that a Certificate of Disposition on NAV-

COMPT Form 741 (figure II-4-13) be prepared

by the chapel fund administrator and be sub-

mitted to the commanding officer via the

4-13