unaffected account each time an entry is made,

the chapel fund administrator can check the

figures more easily after each transaction.

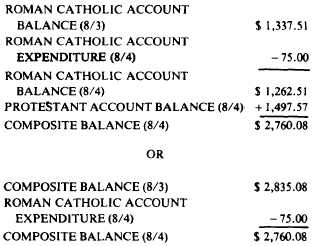

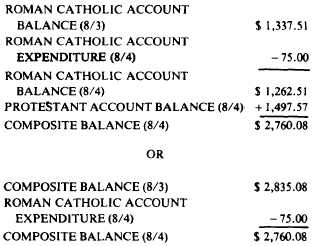

22. COMPOSITE BALANCE—add the

ROMAN CATHOLIC ACCOUNT BALANCE

(

||content||

,262.51) and the PROTESTANT AC-

COUNT BALANCE (

||content||

,497.57). The new

balance is ,760.08. Remember to check the

figures.

Either or both of the foregoing procedures may

be utilized to ensure that the figures are

accurate. After the entries have been completed

on the Receipts and Expenditures Record, there

is one final thing that must be done. The COM-

POSITE BALANCE in the Receipts and Expen-

ditures Record must be cross-checked with the

latest balance in the checkbook to ensure that

the figures are accurate. Since the records for a

complete checking account are not being main-

tained for this practice accounting application, it

may be assumed that all the entries on the

Receipts and Expenditures Record in the COM-

POSITE BALANCE column equal the sum of

the latest checkbook figure plus the in the

petty cash fund.

This completes the required steps for posting

the purchase of the religious medals. A brief

summary should help clear up any problem

areaa. Part 1 of the Purchase Order (NAV-

COMPT Form 2213) will not be mentioned in

this summary since it would have been mailed to

the vendor on the day that it was prepared (July

17, 1980).

. Purchase Order (Part 3)—after the mer-

chandise arrives, the Roman Catholic account

custodian should perform the following steps:

a. Check the shipment for damaged

goods.

b. Count the items in the shipment to

make sure that the number ordered coincides

with the number received.

c. After verifying that the goods were

not damaged and the shipment matched what

was ordered, the account custodian dates the

bottom half of the Part 3 and enteres the words

“Authorized for Payment” on the form and

gives Part 3 to the chapel fund administrator.

. Checking Account—after receiving the

“Authorized for Payment” Part 3, the chapel

fund administrator should take the following

steps:

a. Issue and mail a check to the company

from which the goods were ordered.

b. Post the check and subtract the

amount of this check from the previous balance

in the checkbook.

. Receipts and Expenditures Record—after

issuing the check, the chapel fund administrator

should take the following steps:

a. Post all the required entries to the

account which is affected by this transaction.

b. Compute the new balance for the

affected account.

c. Carry forward the last balance of the

account not affected by this transaction.

d. Figure the new composite balance by

adding the Roman Catholic account balance to

the Protestant account balance.

e. Compare the new composite balance

with the latest balance in the checkbook. If they

are the same after adding the in the petty

cash fund to the latest checkbook balance, then

the chapel fund administrator is ready for the

next transaction.

AUGUST 7, 1980

The Protestant advisory council held a

luncheon today for the prospective Sunday

4-28